The Ideal Board

Independent Non Execs

Non-Execs For AIM Companies

Non Execs For Young Companies

1. Cookies Overview

Our website uses cookies for collecting non personal user information from the site, we do not collect any information about you except that required for system administration.

Cookies are pieces of data created when you visit a site, and contain a unique, anonymous number. They are stored in the cookie directory of your hard drive, and do not expire at the end of your session.

A cookie will typically contain the name of the domain from which the cookie has come; the lifetime of the cookie; and a value, usually a randomly generated unique number.

Cookies may also be used by us to establish statistics about the use of the Site by Internet users by gathering and analysing data such as: most visited pages, time spent by users on each page, site performance, etc. By collecting and using such data, we hope to improve the quality of the Site. Cookies do not contain any personal information about you and cannot be used to identify an individual user. If you choose not to accept the cookie, this will not affect your access to the majority of facilities available on our website.

Cookies used on our Site are only active for the duration of your visit. Cookies used on this site are not stored on a visitor’s computer once you have closed your web browser. Information generated by the use of cookies may be compiled into an aggregate form so that no individual can be identified.

Although your browser may be set up to allow the creation of cookies, you can specify before a site puts a cookie on your hard disk, so you can decide whether to allow or disallow the cookie. Alternatively, you can set your computer not to accept any cookie.

We use analytics programs to gather non-personal data regarding the visitors to our site on our behalf using cookies and code embedded in the site. Both the cookies and the embedded code provide non-personal statistical information about visits to pages on the site, the duration of individual page view, paths taken by visitors through the site, data on visitors' screen settings and other general information.

First Flight systems administration team uses this type of information, as with that obtained from any other cookies used on the site, to help us improve the service to our users and the efficiency and security of our systems.

2. Blocking Our Cookies

First Flight does not use cookies to collect personally identifiable information about you. However, if you wish to restrict or block the cookies which are set by our website you can do this through your browser settings. The Help function within your browser will tell you how to do this.

Alternatively, you may wish to visit www.aboutcookies.org which contains comprehensive information on how to do this on a wide variety of browsers. You will also find details on how to delete cookies from your machine as well as more general information about cookies.

Please be aware that restricting cookies may impact or reduce the functionality of our website.

If you wish to view the information contained in your cookie, just click on a cookie to open it. You'll see a short string of text and numbers. The numbers are your identification card, which can only be seen by the server that gave you the cookie. Some cookies expire as soon as you leave the website and some last for several months or years.

For information on how to do this on the browser of your mobile phone you will need to refer to your handset manual.

3. Cookies set by Third Parties

We sometimes embed photos and video content from websites such as YouTube. As a result, when you visit a page with content embedded from, for example, YouTube you may be presented with cookies from these websites. First Flight does not control the dissemination or operation of these cookies.

4. Contact Information

Data Protection Manager: Ian Hobday

First Flight NED and Advisors Ltd

Hatherley House, Bisley Green, Bisley, Woking GU24 9EY

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

If you decline the use of cookies you will not be able to login to our site and services may be restricted.

|

Blah, Blah, Blah

|

Blah, Blah, Blah

|

Blah, Blah, Blah...... |

|

Blah, Blah, Blah

|

Blah, Blah, Blah |

|

AIM is a Listed market for small and medium sized growth companies, established in June 1995 as part of the London Stock Exchange. It is a geographically and sector-diverse market, with companies operating in over 100 countries, representing 40 different sectors ranging from financial services firms to healthcare and technology companies.

First Flight has recently become a preferred partner of the London Stock Exchange Issuer Services Marketplace as a provider of Chairs, Non-Execs & Advisory Boards to smaller quoted companies on the Main Market & AIM.

Being an AIM listed search & selection company means we have a particular focus working with AIM & FTSE Small Cap Clients; we are the only Search firm that works with the LSE.

The LSE listing rules changed in September 2018 and one new requirement is for all AIM Companies to comply with a Code: either the UK Corporate Governance Code or the Quoted Company Alliance Code.

The Quoted Company Alliance (QCA) Code has ten principles of good Governance: For companies to deliver growth in long-term shareholder value, requires an efficient and dynamic management framework and should be accompanied by good communication which helps to promote confidence and trust.

A Non-Executive Director who becomes involved with a company early enough in the IPO process can have a significant impac on the IPO success.

As an AIM Board Non-Exec search agency First Flight is passionate about helping AIM Companies strengthen their Boards by providing high calibre, commercial Non-Execs who can really add value to the business.

We strike the right balance with our candidates between good Governance and strong entrepreneurial experience particularly relevant for AIM and we currently run at around 35% Women Non Exec placements.

We work with our AIM clients to assess what skills and personalities their Boards will benefit from, we focus our search for our clients on the key or specific skills you require from your Non-Exec(s) along with our experience of understanding the importance of diversity, not only skills and gender but culture and fit for your Board. We have a clear view of how to build ‘the ideal Board’ and how to achieve this successfully.

We know that the appointment of the right Non-Exec is crucial to the effectiveness of your Board and selecting the right Non-Execs has never been more vital to the success of your business and the support of shareholders.

What sets First Flight apart from other search firms is our understanding of Board dynamics and having the broadest reach of any search firm to identify the right Chairs and Non-Execs.

First Flight specialises in providing clients with Chairs, Non-Execs, Advisory Board Members and Trustees. We have proven our ability to come up with high impact candidates that other search firms are unable to locate. We are function specialists. Our ability to come up with outstanding long lists for our clients using our methodology to build an outstanding reputation as a leading Non-Exec Search firm. These are the sectors where First Flight have had the most significant experience:

First Flight’s Board review is the most effective means for identifying areas for improving performance within a Board. Competency frameworks are used to identify Director skills, mind-set and diversity issues, and ensure current Directors are being properly utilised. Leading practice recommends that a Board review should involve the Board as a whole, but also review the contribution of individual Directors through an externally facilitated process of evaluation.

The objective of good Corporate Governance is to facilitate, effective, entrepreneurial and prudent management that can deliver the long-term success of the company.

The framework provides a measurable and achievable guide to the knowledge, skills and mind-set required for Directors to perform effectively and to successfully lead your organisation whatever your sector, industry or location.

A Board review will assess how a Board is performing and as an overview can:

The Competency Framework is built around three dimensions:

1) Knowledge – Director understanding and appropriate application of essential practical and theoretical information; eg strategy, operations, entrepreneurial & finance.

2) Skills – expertise that Directors bring to the Board; eg Corporate Governance, digital/E-Commerce, analytical skills, legal, HR etc

3) Mind-set – attitude and disposition that shapes a Director’s responses, behaviour and contribution; eg independence, ethics, prepares well etc

Within each of the three dimensions Knowledge, Skills and Mind-Set we review a set of core competencies and actionable standards enabling us to assess the strengths and weaknesses of Directors, identify areas for performance improvement and plan for development and succession planning.

The Board should debate and agree the best strategy for the company and set itself regular performance objectives and regularly review its achievement against the objectives it sets.

The ideal Board should be both entrepreneurial and deliver robust and effective risk management. Possess a diversity of skills, personalities, age, gender and knowledge to ensure it can debate healthily and deliver against future strategies.

Appointing Non-Executive Directors is an ideal way to address skills and/or diversity and independence issues that the Board may not currently have.

For more information please email This email address is being protected from spambots. You need JavaScript enabled to view it.

Good Boards are created by good Chairs. The Chair creates the conditions for effective Boards and the effectiveness of individual Directors including the Non-Executive Directors (NEDs).

The UK Corporate Governance Code states: “The Chair leads the Board and is responsible for its overall effectiveness in directing the company. He/she should demonstrate objective judgement throughout their tenure and promote a culture of openness and debate. In addition, the Chair facilitates constructive Board relations and the effective contribution of all Non-Executive Directors, and ensures that Directors receive accurate, timely and clear information.”

Being a good Chair requires considerable skills including:

The principal considerations of the Board Chair role are clear...the difficulty is putting them into practice!

Areas where Boards are not working well are generally due to a lack of trust and respect plus either the wrong or ineffective Chair &/or Non Execs.

Good Boards are created by good Chairs and a good Chair is crucial to the effective running of the Board. An effective Board is in turn crucial to the success of the company.

The Chair creates the conditions for effective Boards and the effectiveness of individual Directors. It is the responsibility of the Chair to lead the Board - the CEO leads the company.

The Chair should provide strong but not dominant leadership, whilst encouraging all Board members to contribute and robustly debate all key issues. He/she must ensure the effective implementation of Board decisions.

Written by Chris Spencer-Phillips, Managing DirectorFirst Flight Non-Executive Directors LtdApril 2020Different types of companies have different types of Boards and successful AIM companies judged by financial performance and with good relations with shareholders usually have one thing in common – they have effective, diverse, entrepreneurial Boards with a number of truly independent Non-Executive Directors who bring diversity and specific skills to the Board. These Non Execs will genuinely question and challenge the Executive but act in a supportive way. If the Non Execs have the right skills and experience they will not let the Execs make bad decisions or get away with remuneration agreements which are out of kilter with the size of the company.

Shareholders in AIM companies, whether institutional or individuals have become more and more conscious of the need to have effective Non Execs and the potential dangers of investing in companies who don’t have truly independent and effective Non Execs.

Some AIM companies have “obtained” their Non Execs from their Nominated Advisor (NOMAD) or Broker but these Non Execs are not chosen from a targetted long-list and seldom appointed for their specific skills and sometomes have too many roles to be effective (over-Boarded). The pool of Non Execs that NOMADs and Brokers have historically worked with has become limited. For example if the business is a technology one then the Non Execs will need to understand technology otherwise they will be “fringe” Directors and unable to add value.

The London Stock Exchange (LSE) changed the rules for AIM Companies in September 2018 which has changed the Governance landscape who now have to "comply or explain" with a recognised Governance Code. The two codes are The UK Corporate Governance Code (with its 45 or so provisions) or the Quoted Company Alliance (QCA) Code with its ten provisions. This has increased the demand in AIM COmpanies for Board Reviews, diversity on Boards and truly Independent Non Execs..One of the most crucial is that the Non Execs should be truly independent.

In 2018 First Flight became a preferred partner of the London Stock Exchange as a provider of Chairs, Non Execs & Advisory Boards to smaller quoted companies on the Main Market & AIM companies:

With a large number of AIM Clients First Flight have become a specialist Search firm for AIM companies with a process ensures that the best Non Execs are “identified” through a formal, rigorous and transparent process which will identify a wide choice of suitable candidates who have specific skills rather that an arbitrary act or the appointment of a “friend” or colleague.

All Non Execs should sit on a Sub-Committee – which includes Audit, Risk, Nomination and Remuneration and sometimes specialist Sub-Committees such as Consumer or Technology.

Who better to summarise the need to find the “right” Non Execs than Warren Buffett who says: “It is desirable for Boards to have “Outside” Directors (as he calls them) but they must:

too often Outside Directors are selected simply because they are “prominent people” – this is a mistake” he concludes.

First Flight works with a number of AIM companies (and pre IPO Companies) and understands the dynamics of effective Boards and the benefits of appointing the right Non Execs.

First Flight is a specialist Chair and Non-Executive Director search firm founded in 2004.

We are the only UK search firm focusing solely on providing Chairs and Non Execs, Trustees and Advisory Board Members.

Every search we manage is carefully tailored with a focus on independence, diversity, quality and effectiveness.

Our clients include: FTSE, AIM, Investment Trusts, growth companies, PE Backed, family businesses, not-for-profits and charities.

We know that the appointment of the right Chair and Non Exec is crucial to the effectiveness of a Board and selecting the right candidates has never been more vital to the success of an organisation – not just a good candidate but the best candidate.

What sets First Flight apart from other Search firms is our understanding of Board dynamics and achieving a high success rate providing diverse candidates – skills, gender, age and ethnicity.

We have many AIM Clients such as Trackwise, ZOO Digital, Angle, Ceres Power, Cambridge Cognition, Ideagen, Proactis, Pressure Technology and understand the challenges that AIM companies face between being entrepreneurial and ensuring good Governance, helping strike the right balance to achieve this when selecting candidates for Non Exec roles.

We are fully conversant with both the UK Corporate Governance Code and the Quoted Company Alliance (QCA) Code.

First Flight Services include:

We have worked with many Financial Services clients such as Weatherbys Bank, British Friendly Society, Cirencester Friendly Society, Institute and Faculty of Actuaries, Invesco Perpetual and understand the regulatory issues of the FS sector.

As the first specialist UK Chair & Non Exec Search firm, First Flight has and continues to help raise the standards and effectiveness of UK Chairs and Non-Executive Directors. We aim to continue to broaden the Non-Exec gene pool and provide more diverse Candidates.

Non-Executive Directors (NEDs) are appointed to provide companies with advice and support. They are appointed to tactfully contest strategies to glean the best results from management for business. The role is often challenging and requires the individual to be equipped with specific knowledge and expertise, confidence and analytical skills, whilst maintaining an external and objective viewpoint in order to contribute to an effective Board.

Legally, there is no distinction between Executive and Non-Executive Directors and, for this reason, the UK unitary Board structure concludes that NEDs share the same responsibilities, legal duties, and potential risks as their Executive colleagues. It is common knowledge that Non-Executive Directors cannot deliver the equivalent seamless attention to the business, as they are not, or at least should not be, involved in detail. However it is essential that they share the same drive for success as their Executive associates.

Non Executive Director Responsibilities

In terms of key responsibilities, NEDs should be regarded as leadership contributors. Chairmen and Chief Executives should harness their Non-Executive Directors to provide general counsel and seek their guidance on particular issues before they are raised in Board meetings. A Non-Executive Director is appointed to benefit the development of business strategy and effectively challenge strategic plans made by management. The independent viewpoint that the NED maintains (away from the day-to-day activities of company management) allows for better focus upon challenging and revising company strategy and maintaining objectives.

Risk Management Process

In another light, NEDs are expected to ensure appropriate risk management schemes are in place and guarantee internal control frameworks are implemented regarding all characteristics of the business. One of these features for the NED is filling key business leadership positions within the company through successful succession planning.

Performance Monitoring

NED Directors should also take responsibility for monitoring the performance of Executive management and, in some cases, mentoring them - especially in regards to the progress made towards achieving the company strategy and objectives. The Non-Executive Director must also ensure that KPIs are met by the management team and involve themselves heavily in problem solving, financial queries, audits, and measurement activities.

Professional Networking

Furthermore, the unique contacts that the NED can bring to the table is a clear indication that outside sources can be a benefit to business. Broadening professional networks can help bring useful individuals and organisations on Board to strengthen business and the NED will also be called upon to represent the company externally and aid the Board in keeping stakeholders, customers, shareholders and third parties informed appropriately.

Business Challenges

As well as germinating strong communication ties between the company and outside sources, Non-Executive Directors should involve themselves with any company difficulties, such as trading troubles through changes in the market or ineffective governance and management. The NED should ensure the reliability of financial information that they are provided with and that the company publishes and also ensure that financial controls and risk management systems are strong and secure.

Personal Skills

A NED works in an advisory capacity only and is therefore expected to be truly independent, as an individual with no links to the company so that their perspective is not tainted. However, the Non-Executive Director does not have to work in isolation; discussions are encouraged, but it is imperative any decisions made are solely that of the NED. Having a strong and persistent character is ideal for these situations, and the ability to voice “no” decisions, tactfully deliver criticisms and command attention from a Board are key attributes.

Management Induction Programme

For the above reasons, it is essential that newly appointed Non-Executive Directors receive a full induction to the company (and continuing development) to understand the business fully. Tours, liaising with key managers, assessing competitors and understanding USPs, are all important ways for NEDs to contribute and assimilate into the company effectively.

The Companies Act in 2006 is the main piece of legislation which governs company law in the UK and has a number of statutory duties applied to all Directors irrespective of company size or Executive or Non-Executive standing.

Directors Duties

• A Director must act in accordance with the company’s constitution and only exercise powers for the purpose which they are conferred.

• Act in good faith, with regard to likely consequences of any decision in the long term; the interests of employees, community and the environment; and the desirability of the company maintaining a reputation for high standards of business conduct.

• Exercise independent judgement

• Exercise the care, skill and diligence of a ‘reasonably diligent person’.

• Avoid situations of direct or indirect interest that conflicts the interests of the company; these should be managed and declared,

• Must not accept any benefit from a third party which may cause conflict of interest (scale of benefit is critical, for example; lunch may be fine whereas a holiday is not).

• Must declare the nature and extent of any personal interest in a proposed transaction with the company to the other Directors before the company enters into transaction

However, these are not the only considerations for Non-Executive and Executive Directors alike, other duties a Director should consider include:

• Duty of confidentiality

• Duty to devote sufficient time and attention

• Duty to account to shareholders

• Duty not to make ‘secret profits’

• Stewardship of the company assets

• A general duty to act in good faith

• Duty to file accounts, annual returns, and tax returns

• Duty to maintain statutory books

• Duty to ensure the company is complying with legislation including, in particular, those involving risk to third parties, for example, health and safety at work

The skills of a Non Exec will vary from appointment to appointment but a Board should aim to have a balance of skills and experience that is appropriate for the size and requirements of business. Skill gaps can be identified by Board members and filled appropriately by appointing new Non-Executive Directors. The Board want to ensure the success of the company and therefore, it is of high importance that varied skill sets of Non-Executive Directors are valued.

The business issues of a company should be focused upon by all Directors; with a broad perspective. The benefit of NEDs is that they can be of a high level of professional competence and can bring a wide array of experience and personal attributes to the table. Furthermore, many Non-Executive Directors are armed with varying degrees of specialist knowledge that can help deliver prized perceptions to the Board or offer key contacts.

Board Objectives

Most valued, is Non Execs ability to stand apart from the management of the company; this ensures objectivity to the decisions and dilemmas facing the Board and provides a key role in the monitoring of Executive management.

NEDs should be astute to Board matters and are expected not to stray into providing Executive direction; enabling an unbiased view of the company as the individual is not cohesive with the day-to-day running of the business. Non-Executive Directors are expected to bring not only personal attributes and professional knowledge to the table, but also draw on their wide professional experience and perform with independence and impartiality.

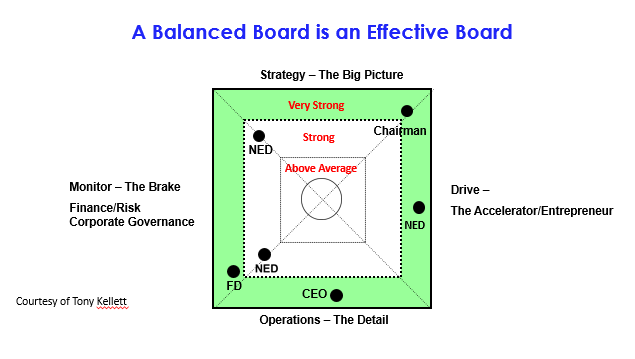

Balanced Board of Directors

Achieving a Balanced Board of Directors is a challenging but rewarding task for business. The Matrix, shown below, suggests four areas of expertise to address when businesses look to create an effective Board.

The polar opposites are: strategy ‹ › operations and drive ‹ › monitor

First Flight recommends Boards should have at least one, ideally two Directors with each of these four core skills:

• Strategic - the big picture looking to challenge and shape the future;

• Operational – the detail looking to make sure actions and plans are consistent with the strategy and will deliver the required performance;

• Drive – the accelerator and entrepreneurial abilities to drive the organisation forward and overcome obstacles;

• Monitoring Risk – the brake and Governance to be able to identify risk areas and issues and stop the organisation doing the wrong things.

These four areas reflect four separate and independent dimensions of Board dynamics which form two opposing pairs in terms of interaction: strategy (the big picture) ‹ › operations (the detail) and drive (the accelerator) ‹ › monitor (the brake) and each of these core skills should be provided to the Board by its Directors. Boards that are well represented with each of these skills will be more effective.

An example of one side pulling too hard in a direction with drastic consequences is in the banking sector, and that error was a catalyst for the Banking Crisis experienced in the late noughties.

Initially, the Boards of Banks were too heavily weighted on the ‘Monitor’ side of the Matrix, meaning that these boards were placing too much emphasis on risk averse strategies with board members from finance, regulatory and Corporate Governance backgrounds helping to make those decisions.

The Boards of Banks realised that this situation had occurred and as a method to rectify the risk adverse model they had been following, they introduced more ‘Drive’ into their Boards however, they did not find an appropriate balance and over-skewed in Drive’s favour. This resulted in the Boards of Banks and Banking sector becoming cavalier and overly entrepreneurial in their approach to business.

As we have the benefit of hindsight, we now know that the Banking sectors’ cavalier approach was doomed, being responsible for the years of reverberating damage caused to our economy.

The impact of the over-zealous, skewed weight of Bank’s Boards was clear for all to see in the years that followed and acts as a fantastic example of ‘Groupthink’.

Groupthink is a term used to describe a psychological phenomenon that occurs within a group of people responsible for decision making. The situation is not appropriately or in most cases, logically dealt with as a result of the desire for harmony and conformity within the group of decision makers. In a method to reduce confliction between the group of decision makers, a decision is reached that may actually be irrational when considered outside of the decision making situation (most usually, where it will have the largest impact).

This phenomenon is more likely to become a factor within unbalanced, skewed Boards which is a great protagonist for the creation of a Balanced Board of Directors. As balanced Boards will provide voices, opinions from the different ‘sides’ and angles of the business it can be assumed that these sides would not necessarily agree on decision making but instead find a comprisable agreement between each ‘side’ to form a decision that takes into account each of those ‘sides’ viewpoint and will result in better, balanced decision making that considers all aspects of a business and the impact of those decisions on stakeholders.

Other famous examples of Groupthink that caused devastating consequences include; the attack on Pearl Harbour, escalation of the Vietnam War and most recently, the invasions on Afghanistan and Iraq on claims of Weapons of Mass Destruction.

Although the four skills outlined in the above matrixes are essential core capabilities that appear in the majority of Non Exec job specifications, skills are evolving and digital communications, HR and legal are being added to the operations quadrant.

A recent survey of FTSE companies indicated that there is a shortage of NEDs with a digital background. However, much of this is a fault could be that of the major search firms looking for candidates in prior FTSE directors. It is time to cast the net for a varied pool of talent to aid the creation of balanced, effective Boards.

Company Expectations

Essentially, a Non-Executive Director is expected to be a cohesive and influential member of the Board whilst maintaining an independent and outside perspective. Their contribution to strategic leadership is imperative and the NED must be prepared to challenge Executive recommendations to strengthen business. They are also expected to draw upon their valuable skills and experience to execute their role effectively in relation to:

• Setting and revising company strategy and objectives

• Risk management and internal control framework implementation

• Succession planning

Employee Expectations

However, for an NED, it is equally as important to understand what they can expect from a company on appointment. Taking on a role as a Non-Executive Director can broaden experience and elevate skill sets to the next level.

The NED must have a clear understanding of what is expected from him/her and the control and responsibilities they will have under company legislation. Furthermore, the skills and expertise the company wishes to utilise from them must be detailed, along with notes on time commitment desired from the NED both in terms of formal time and informal time. Appointments must include a clear description of the role in the letter of appointment, an appropriate fee and Directors’ and Officers’ (D & O) insurance.

It is beneficial for prospective NEDs to liaise with the company Chairman, other Directors and senior management to discuss and agree the role in-depth. This would also be an ideal opportunity for the NED to gain an extensive understanding of the business of the company.

• Induction about the company

• Annual agenda of Board meetings, with meetings held at regular intervals, and with sufficient time given to each point to be discussed

• Which Sub-Committees will the Non Exec sit on or Chair – all Non Execs should join one or more Sub-Committees (Audit, Risk, Remuneration, Nomination, Consumer etc)

• Receive Board papers of an appropriate length and quality in order to prepare for meetings

• Receive timely minutes that effectively reflect the discussions and decisions taken at the meetings

Non-Executive Directors are expected to be treated as other Directors to allow for full participation at Board meetings. With all Board members being held responsible for the success of business, it is essential that Board members relay key risks to the NED as they are not involved in the day-to-day running of the business. Therefore, the Non-Executive Director needs to have confidence in Board members to adequately identify, record, control and report risks to them.

Working as a Non-Executive Director associates the individual with a company and its Board which carries legal, financial and reputational risks.

Risk management in itself is a cycle of identifying, assessing, monitoring and mitigating risks. This may not result in the removal of acknowledged risk, but the process in which to handle circumstances correctly and affectively. The NED, although collectively responsible for risk management along with all Board members, is heavily reliant upon the internal controls already in place working properly and the Non-Executive Director may need to seek professional advice from an accountant, insolvency practitioner or lawyer following the identification of a financial problem.

It goes without saying that risk is congruent with business. Risk is a pitfall that businesses face regularly and systems initiated must be able to adapt, escalate and control to address the challenge and report to the Board immediately. An effective system of internal control is fundamental to robust risk management and regular checks of set procedures are vital to maintain an effective control system.

Difficulties

It is possible that a company may get into trading difficulties through a changing market or through ineffective management and governance and these issues can escalate. A Non Exec must be fully aware of the Company’s situation and be au fait with the risks that can arise in adverse trading periods and the impact of those risks on business and their responsibilities. It is the Non-Executive Director’s responsibility to seek professional advice at an early stage.

Wrongful Trading

When a company fails to recognise trading beyond a point at which Directors are aware, it is referred to as wrongful trading and prospects of avoiding insolvency liquidation are slim. A company is considered insolvent when it cannot pay debts on time or when the value of its assets are less than the liabilities. Directors can find themselves in the firing line for the company’s debts if they do not strive to minimise loss to the company’s creditors.

Insolvency

A point can be reached when a company has to admit serious fault and an insolvency practitioner is called upon as soon as possible. The advice given will enable Directors to deliver correct governance and management to validate that they have endeavoured to avoid wrongful trading. As previously mentioned, the NED plays no part in the day-to-day activities of the company and therefore, the Non-Executive Director must be made aware immediately of any signs that the business is deteriorating, allowing them to manage the situation and challenge any reassurances that management may give.

The Role of a NED

The role of a NED is challenging position, independently providing advice and method to a business to help overcome business challenges. However, the reward can be great in regard to remuneration and sense of accomplishment.

The role is ever-changing, continuing to develop over past years’ alongside businesses need and desire for an effective board that can help improve aspects of a business.

More and more businesses are understanding the advantages to employing an independent Non-Executive Director to their board which provides greater opportunities for prospective NEDs.

First Flight Non-Executive Directors specialise in the search and selection of Non-Executive Directors. Aiming to broaden the Non-Exec gene pool and provide more diverse candidates to clients.

First Flight is the ideal place for candidates looking for a Non-Exec Role to begin their search, please contact us to discuss your requirements.

The independence of a Non-Executive Director should be agreed by the rest of the Board. If the Non-Exec is being proposed because he or she is a friend of the Chairman or CEO then they do not satisfy the independence criteria and it is hard to see how such a Non Exec can be truly effective and research indicates that this is often the case when “friends” are appointed as Non Execs.

Ineffective Non-Executive Directors result in ineffective Boards which can be enormously expensive and sadly we see many examples of this.

There is a difference between being a good Non Exec and being the right Non Exec for a particular role, and this difference is often a specific skill-set or background that an organisation believes is important to have around its Boardroom table.

Some examples of Non Exec projects that First Flight have undertaken recently are:

In these examples it is very difficult if not impossible for the Non Exec to be objective and contribute effectively unless they are truly Independent.

Good NEDs should be able to offer objective oversight and knowledgeable independence to help resolve disagreements impartially and make sure difficult decisions are taken wisely.

For Non Execs to be effective they must, in our view be able to think and speak independently.

In addition to providing clients with the best Chairs and Non-Executive Directors who have the time available to be truly effective, First Flight provides the following expert analysis of the composition, structure, commitment and remuneration of your Board and its alignment to your strategic goals. First Flight Pre-Search Services:

We work with you to ascertain what skills your Board requires to achieve your objectives, what skills you currently have around the Boardroom table and where the gaps are. We cover functional and technical expertise, industry/market knowledge, key event experience, hard and soft skills, formal and informal roles within the Board and how the Board contributes to diversity goals.

We work with you to produce a succession plan for your Non Execs. We examine the specific skills they have, their input, how many other roles they have, their tenure and re-election dates, and what sort of Non Execs your Board will benefit from and who we can provide you with in the future.

We can provide a Board benchmarking service comparing your company with organisations that you see as your closest peers. Metrics include: Chair and NED remuneration, Chair and NED time commitment and involvement, Board size and diversity and Sub-Committee structure. As part of this service we recommend what you should pay your Non Execs.

We are pleased to offer companies personalised seminars that will help your NED's understand not only the legal and practical responsibilities of the Non-Exec Director but the key skills to being an effective Non-Executive Director. We can tailor these seminars to cover the following topics:

We have been running a range of events over the years for CEO’s, Company Chair and Non-Executive Directors including talks by guest speakers. Our Board events have provided an opportunity for us to share knowledge and experience of the Non-Exec landscape and how to achieve effective Boards. Areas covered include:

Guest speakers:

Jane Mitchell, JL&M Ltd

Jane’s career started in television broadcasting at the BBC in London, where she worked with the best in the business on such TV icons as Tomorrow’s World, Grange Hill and Blue Peter. It was at that early stage that she developed a passion for effective communication and learned the value of mutual respect and great teamwork.

Jane’s career started in television broadcasting at the BBC in London, where she worked with the best in the business on such TV icons as Tomorrow’s World, Grange Hill and Blue Peter. It was at that early stage that she developed a passion for effective communication and learned the value of mutual respect and great teamwork.

In 2005, Jane set up JL&M and now advises, 'guides' and supports (some might say challenge), leaders in organisations large and small, as they find ways to embed their ethics, values-based leadership and behaviours. At the heart of Jane's work is the principle that people willingly take responsibility for their own behaviour and actions at work when they understand what the ‘corporate’ ambition is and how they can contribute to it, and are recognised for that effort. “There is wisdom, knowledge and enthusiasm at every level of an organisation and when dots are connected effectively the insights everyone gains can be harnessed to drive real and positive change.” It's connecting the dots that is the key.

Janes’ clients who have had the courage to tackle these difficult issues, include Rolls-Royce Holdings, BAE Systems, BP, SERCO, Meggitt, BT and Co-operative Bank.

Jennifer Palmer, BA (Hons), FCIS, MIoD, SMIRM

Jennifer began her City career in 1993, enjoying success in executive recruitment before joining JPMorgan and qualifying as a Chartered Secretary. Since then she has worked for a number of FTSE 100 banks and financial institutions including Macquarie Group and Standard Bank Group before becoming the Deputy Head of Global Assurance for RBS.

Jennifer began her City career in 1993, enjoying success in executive recruitment before joining JPMorgan and qualifying as a Chartered Secretary. Since then she has worked for a number of FTSE 100 banks and financial institutions including Macquarie Group and Standard Bank Group before becoming the Deputy Head of Global Assurance for RBS.

In 2014 Jennifer set up Goldstream Governance Ltd a specialist consultancy providing corporate governance, operational risk management and assurance expertise.

Her recent appointments include interim Director of Governance, Risk, Legal and Compliance for a NHS Financial Trust and Special Advisor to an internationally renowned governance consultancy.

Cliff Weight, Director and Executive Compensation Consultant

Cliff Weight is a Non Exec at Share Soc, the Individual Shareholders Association, and has developed ShareSoc’s Remuneration Guidance, which contains specific recommendations for companies with less than £200 million market cap. Cliff is the author of the Directors’ Remuneration Handbook and has over 30 years’ experience as a remuneration consultant. Cliff is a member of the QCA Corporate Governance Expert Group, the Advisory Board of the High Pay Centre, the Editorial Board of Executive Compensation Briefing, and is a Non-Executive Director of MM&K, the leading independent remuneration consultant and Manifest who provide Corporate Governance research and voting services to investors and others.

Cliff Weight is a Non Exec at Share Soc, the Individual Shareholders Association, and has developed ShareSoc’s Remuneration Guidance, which contains specific recommendations for companies with less than £200 million market cap. Cliff is the author of the Directors’ Remuneration Handbook and has over 30 years’ experience as a remuneration consultant. Cliff is a member of the QCA Corporate Governance Expert Group, the Advisory Board of the High Pay Centre, the Editorial Board of Executive Compensation Briefing, and is a Non-Executive Director of MM&K, the leading independent remuneration consultant and Manifest who provide Corporate Governance research and voting services to investors and others.

In addition to providing clients with the best Chairs and Non-Executive Directors who have the time available to be truly effective, First Flight provides the following expert analysis of the composition, structure, commitment and remuneration of your Board and its alignment to your strategic goals.

First Flight Pre-Search Services:

Young companies should consider bringing in a Chairman and a Non-Executive Director or at least a Non Exec as they will be of great benefit enabling them to grow with a solid foundation and experience and ensure that key decisions you make are the right decisions.

The benefits of Non Execs for young companies:

More often than not, young companies struggle to gain funding due to the lack of credibility in their management team and this shortcoming can be addressed with the appointment of a high calibre, successful and experienced Chairman and/or a Non-Executive Director including maybe a Non Exec FD to ensure the finances are well managed.

First Flight very much work on the credo that successful companies are 85% good management and 15% good idea and it is widely accepted that funding tends to follow successful people which Non Execs have to be.

Businesses are started by passionate entrepreneurs - people with a vision and talent in their fields. However there are often skill and experience gaps at Board level that may hold the business back, cause it to make wrong decisions and concern investors. A Non-Exec is an affordable way to access those skills and experience.

If SMEs/Growth Companies are considering strengthening their Board they should consider appointing a Non Exec and should use a provider with considerable experience of helping young growth companies. First Flight has handled hundreds of Non Exec projects over the years for young companies. In addition to providing Non Execs who are “business savvy”, add value and contribute to the success of the company they also sometimes consider investing to align their interest with the existing Directors who are likely to be shareholders – this is known as “smart money” and the added commitment of a Non Exec having some “skin in the game” is beneficial and gives comfort to outside investors.

First Flight advocates that for companies with a turnover of less than £1m the Non Execs should not be paid any fees and should be focused on preserving cash and growing the business; this is only practical when the Non Execs invest and of course this is a most cost effective option – a wise owl or two and no cost!

Investing Non Execs for young companies:

Young companies are the future and should be encouraged but they face two challenges: a) lack of funds b) lack of experience.

Getting funding remains a challenge for young companies. Businesses are started by passionate entrepreneurs - people with a vision and talent in their field which is what is needed to get a new concept off the ground.

Investing Non-Execs, who have grown a business and been involved with success are an invaluable asset. First Flight pioneered the concept of investing Non-Executive Directors and have completed some 140 projects helping young companies.

In addition to adding valuable business skills and experience, Non-Execs can fulfil various functions at different phases of a company’s development, including introducing valuable contacts. EIS and SEIS tax relief makes investing in early-stage businesses attractive, on average a Non-Exec will invest £25k so two NEDs can provide £50k.

Overall Non-Execs are an effective way to access experience as well as funding and can play a crucial part in the future success of a young business.

The independence of a Non-Executive Director should be agreed by the rest of the Board. If the Non-Exec is being proposed because he or she is a friend of the Chairman or CEO then they do not satisfy the independence criteria and it is hard to see how such a Non Exec can be truly effective and research indicates that this is often the case when “friends” are appointed as Non Execs.

Ineffective Non-Executive Directors result in ineffective Boards which can be enormously expensive and sadly we see many examples of this.

There is a difference between being a good Non Exec and being the right Non Exec for a particular role, and this difference is often a specific skill-set or background that an organisation believes is important to have around its Boardroom table.

Some examples of Non Exec projects that First Flight have undertaken recently are:

In these examples it is very difficult if not impossible for the Non Exec to be objective and contribute effectively unless they are truly Independent.

Good NEDs should be able to offer objective oversight and knowledgeable independence to help resolve disagreements impartially and make sure difficult decisions are taken wisely.

For Non Execs to be effective they must, in our view be able to think and speak independently.

First Flight are committed to helping our clients improve the effectiveness of their Boards by realising the value that diversity can bring.

Over the years, regulators have placed great emphasis on addressing different matters relating to the board of directors. Two prominent examples were: (i) stressing on the roles of non-executive directors as well as the importance of independence of the board in the Higgs Review in 2003; and (ii) emphasising the significance of balancing skills and experience of the board members as in the Walker Review in 2010. Until recently, there has been an urge for diversifying the board. Intuitively, diversity means having a range of many people that are different from each other. There is, however, no uniform definition of board diversity. Traditionally speaking, one can consider factors like age, race, gender, educational background and professional qualifications of the directors to make the board less homogenous. Some may interpret board diversity by taking into account such less tangible factors as life experience and personal attitudes.

In short, board diversity aims to cultivate a broad spectrum of demographic attributes and characteristics in the boardroom. A simple and common measure to promote heterogeneity in the boardroom – commonly known as gender diversity – is to include female representation on the board.

The Benefits of Board Diversity

Diversifying the board is said broadly to have the following benefits:

We work closely with our clients to assist them in developing their Board succession plans utilising diverse talent pools and acknowledging gender balance and equality to achieve Board effectiveness.

We are a signatory to the Voluntary Code of Conduct for Executive Search Firms in Board Appointments – this addresses gender diversity and best practice as a result of the Lord Davies report in 2011 which revealed the low number of women Board members.

One in three of all First Flight's recent Non-Exec and Chair appointments have been women.

First Flight developed the Investing Non Exec concept and we believe in the 85/15 principal. Successful companies are 80% good management and 20% good idea not the other way around! Many young entrepreneurs think a good idea is enough and wonder why they struggle to progress through not having the right Board; they often lack a clear strategy and key skills on their Board which are addressable with the introduction of the right Non Exec or two.

One or more Non-Executives are recruited by a company to bring in additional skills, experience and contacts to an existing Board or Management team. For instance a Board without a qualified accountant may want an experienced former CFO/FD to join as a Non-Exec FD/NED to oversee the finance function; or Directors that have never before raised institutional VC money might want a Chairman or Non Exec who has; or a company that is targeting a certain vertical sector might want a Non Exec with inside knowledge of, and contacts in, that specific sector; or a young management team might simply want a successful entrepreneur to advise them on how to grow a company through to a successful exit because they have already achived this.

As well as working for the company for between 1 and 4 days a month, the Non-Executive Director also invests in it, where possible benefitting from SEIS and EIS tax breaks. Typical investments are around £25,000 so two Non Execs could invest £50,000.

Companies can also leverage the direct ‘smart money’ investment of the Non-Executive Director to attract further funds from matching grants, crowd sourced funding, angels, Venture Capital and Private Equity firms and other sources. The company should be more investable with a NED on the Board who is independent of the management team but who has ’skin in the game’ and whose interests are aligned with all the shareholders. In fact, several PE firms like the Business Growth Fund will only invest in a company if they can find a well-qualified, independent Chairman or Non-Executive Director who will invest alongside them.

Like any other investor, the investing NEDs will seek a return on their investment, but they are also working NEDs and Chairs who will expect a reward for their time and expertise as well. If the company is small and growing fast, this reward may be in additional sweat equity rather than cash. First Flight can advise companies on what they should offer Investing NEDs - and what they should expect from the NEDs in return.

Generally there are two kinds of companies: larger, PE and VC-backed companies whose PE and VC investors want NEDs and Chairmen aligned with their interests who will invest on the same terms as them; and smaller management-owned growth companies who want to strengthen both their Board and their Balance Sheet.

First Flight works with both kinds of companies (and others) and we also work directly for VC and PE firms.

Smaller companies that are interested in our service should have achieved ‘proof of concept' which will mean they have a product, a customer and some revenues. They must also be able to provide us with a clear, detailed Business Plan, up to date trading history or management accounts, historic annual accounts, and (if relevant) their EIS and SEIS certifications.

First Flight was the first recruitment company to provide clients with investing Non-Executive Directors and we have helped dozens of companies in this way – full references available on request.

Approximately two thirds of the 10,500+ Non Executive Director candidates on our database have stated a willingness to invest in the companies they join as a Non-Exec. We also use advertising and specialist search to maximise our clients’ choice of high calibre, board-ready, candidates.

We are experts in helping companies decide what skills and experience they will benefit from in their Non Execs and finding NEDs who fit these exacting profiles.

First Flight is discerning on what clients they are prepared to take on when they are looking for investing Non Execs. We seek assurance that the specific qualities and benefits of a Non Exec are more important than their investment.

We charge for our service but our fees are affordable and the majority of our fees are only collected after the successful candidate has joined and invested in our client’s company.

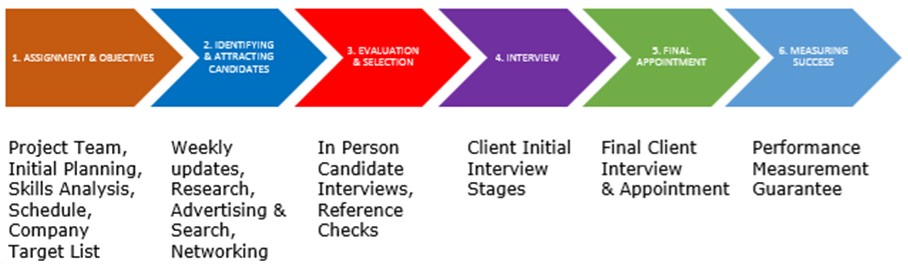

Using First Flight's six-step process, our consultants assess candidates for leadership skills, organisational fit and ability to deliver. You won’t meet anyone who doesn’t match our standards.

Your Non-Exec Director or Chair will be recruited through an independent search and selection process.

An initial planning meeting with yourselves during which we will discuss your specific requirements.

We will provide guidance on remuneration and a skills audit if required.

Final specification will include Non-Executive Director or Chair responsibilities, term of office, time commitment and remuneration and specifically the skills/experience/attributes you require that we will target.

We will use search and research to identify suitable candidates to meet your specific criteria. From your initial email to us we recognise that you are seeking individuals with specific experience.

Using the attributes, qualities, experience and skills stated in your agreed Candidate Role Spec as a benchmark, First Flight will expect to provide you with candidates who 100% meet your criteria.

We will look beyond ‘the usual suspects' to find you the best candidates and we have an excellent track record in achieving Board diversity objectives including skills, gender, age and ethnicity.

Furthermore the candidates we provide to you will not have more than 2-3 other roles so that they will have sufficient time to understand your business and contribute effectively to your Board.

We produce a long list and then a shortlist who will have been personally interviewed.

You will be provided with candidate CVs, their application notes, our interview notes and a score card showing how each candidate meets your criteria.

We will also advise you on final candidate selection, assist you in candidate negotiations and provide you with a template Non-Exec Director or Chair appointment letter (if required).

Advisory Boards come in all shapes and sizes, as do the organisations that establish them. The purpose, however of an advisory board is always the same: to expose the organisation’s Directors to expertise from advisers who will share information and meet regularly.

Advisory Board members Vs Non-Executive Directors on Company Boards

Advisory Boards are purely advisory. Unlike the Company’s Board of Directors, the company’s Advisory Board does not have authority to vote on corporate matters, nor do its members have a legal or fiduciary responsibility to the company or its shareholders. It has no right to obtain information about the company’s activities and unless it can be proven that its members were acting as “shadow Directors”, they can not be held legally responsible for those activities.

In contrast Non-Executive Directors who are members of a company’s Board of Directors have the same powers and legal and fiduciary responsibilities as its Executive Directors. From a legal standpoint, what is important is that they are Directors, not that they are Non-Executives.

Advisory Board members can therefore focus on advising the company on how to achieve specific corporate goals, and their sole job is using their experience, expertise and contacts to help the company’s management succeed in these objectives. Non-Executive Directors who are members of the company’s Board of Directors, have to balance this ‘advisory’ part of their role with supervisory, governance, legal, regulatory and risk management responsibilities. This means they may have to switch between being the CEO’s trusted adviser and being his/her supervisor.

Having said that, if a company has Non Execs on its main Board and then establishes an Advisory Board as well, at least some of the Non Execs will usually sit on both Boards. And NEDs on one company’s Board of Directors can often serve as members of another company’s Advisory Board, provided the two companies do not compete. This is because many of the qualities prized in Non-Executive Directors are the same qualities wanted by Advisory Boards - objective judgement, strategic direction, fresh thinking, constructive challenge, useful contacts and additional areas of expertise.

Advisory Boards v Consultants and Project Boards

Although in a legal sense, members of advisory Boards are just consultants, they tend to work more collaboratively and more strategically than ‘normal’ consulting arrangements. The reason for this is that the Advisory Board’s focal point is its Board meeting. Each member of the Board will do their own preparatory work before the Board meeting, and afterwards many of the agreed action points will involve individuals or sub-groups following up, but the Board itself is a shared occasion with a general principle that all Advisory Board papers are given to all Advisory Board members and all Advisory Board members should be able to contribute to all discussions.

Advisory Boards meet regularly but infrequently - typically 2, 4 or 6 times a year. They therefore tend to focus on strategic and recurring issues rather than projects with definite end dates. If you want NEDs to contribute to the latter (for example, by giving independent expert advice on a major IT systems overhaul) you are better off setting up individual Project Boards that terminate when the project is finished.

Official guidance on Advisory Boards

As Advisory Boards are unofficial rather than legal structures, there is little mention of them in most Governance Codes eg the Financial Reporting Council’s UK Corporate Governance Code does not discuss them, for instance.

One exception is the Institute of Directors’ “Corporate Governance Guidance and Principles for Unlisted Companies in the UK”.

This advocates Advisory Boards but purely as an interim step in the transition from an entrepreneurial Board dominated by its Owner-Manager(s) to a mature Company Board with Non-Executive Directors. The popular practice of having a mature company Board with Non-Executive Directors and an Advisory Board is not mentioned. Instead the Advisory Board is meant to wither away as the company matures and Non-Executive Directors are engaged. This however does not have to be the case as Advisory Boards can be very beneficial for companies of all sizes.

Further advice on creating and recruiting for your Advisory Board

As we said at the start, Advisory Boards come in all shapes and sizes, as do the organisations that establish them and there are very few ‘one size fits all’ rules. However at First Flight we have good experience of helping clients create and recruit for Advisory Boards, and we are always ready to share that experience with a company that is interested in a confidential exploratory discussion. So whether you are a young company who wishes to follow the IoD’s guidance or a mature company that’s realised its Non Execs are spending too much time on Corporate Governance issues and supervision and not enough on giving you the strategic advice you recruited them for, then please get in touch.

Top 10 tips for forming an Advisory Board

Maytham Oast, Rolvenden Layne, Cranbrook, Kent TN17 4QA

01797-270920

www.NonExecDirector.co.uk

Registered in England No: 5871276

This email address is being protected from spambots. You need JavaScript enabled to view it.

Statement for Self-Certified Sophisticated Investor

I declare that I am a self-certified sophisticated investor for the purposes of the Financial Services and Markets Act (Financial Promotion) Order 2005.

I understand that this means:

(a) I can receive financial promotions that may not have been approved by a person authorised by the Prudential Regulatory Authority or the Financial Conduct Authority as Regulators;

(b) the content of such financial promotions may not conform to rules issued by these Regulators;

(c) by signing this statement I may lose significant rights;

(d) I may have no right to complain to these Regulators or the Financial Ombudsman Scheme;

(e) I may have no right to seek compensation from the Financial Services Compensation Scheme. I am a self-certified sophisticated investor because at least one of the following applies -

I accept that I can lose my property and other assets from making investment decisions based on financial promotions.

I am aware that it is open to me to seek advice from someone who specialises in advising on investments.

Signature: Date:

Name (PRINT IN CAPITALS):

Statement for Certified High Net Worth Individuals

I declare that I am a certified high net worth individual for the purposes of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005.

I understand that this means:

I am a certified high net worth individual because at least one of the following applies –

I accept that I can lose my property and other assets from making investment decisions based on financial promotions.

I am aware that it is open to me to seek advice from someone who specialises in advising on investments.

Signature:

Name (PRINT IN CAPITALS):

Date:

Maytham Oast, Rolvenden Layne, Cranbrook, Kent TN17 4QA

01797-270920

www.NonExecDirector.co.uk

Registered in England No: 5871276

This email address is being protected from spambots. You need JavaScript enabled to view it.

Statement for Self-Certified Sophisticated Investor

I declare that I am a self-certified sophisticated investor for the purposes of the Financial Services and Markets Act (Financial Promotion) Order 2005.

I understand that this means:

(a) I can receive financial promotions that may not have been approved by a person authorised by the Prudential Regulatory Authority or the Financial Conduct Authority as Regulators;

(b) the content of such financial promotions may not conform to rules issued by these Regulators;

(c) by signing this statement I may lose significant rights;

(d) I may have no right to complain to these Regulators or the Financial Ombudsman Scheme;

(e) I may have no right to seek compensation from the Financial Services Compensation Scheme. I am a self-certified sophisticated investor because at least one of the following applies -

(a) I am a member of a network or syndicate of business angels and have been so for at least the last six months prior to the date below;

(b) I have made more than one investment in an unlisted company in the two years prior to the date below;

(c) I am working, or have worked in the two years prior to the date below, in a professional capacity in the private equity sector, or in the provision of finance for small and medium enterprises;

(d) I am currently, or have been in the two years prior to the date below, a director of a company with an annual turnover of at least £1 million.

I accept that I can lose my property and other assets from making investment decisions based on financial promotions.

I am aware that it is open to me to seek advice from someone who specialises in advising on investments.

Signature:

Date:

Name (PRINT IN CAPITALS):

Statement for Certified High Net Worth Individuals

I declare that I am a certified high net worth individual for the purposes of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005.

I understand that this means:

a) I can receive financial promotions that may not have been approved by a person authorised by the Prudential Regulatory Authority or the Financial Conduct Authority as Regulators;

b) the content of such financial promotions may not conform to the rules issued by these Regulators;

c) by signing this statement I may lose significant rights;

d) I may have no right to complain to these Regulators or to the Financial Ombudsman Scheme.

e) I may have no right to seek compensation from the Financial Services Compensation Scheme.

I am a certified high net worth individual because at least one of the following applies –

a) I had, during the financial year immediately preceding the date below, an annual income to the value of £100,000 or more; or

b) I held, throughout the financial year immediately preceding the date below, net assets to the value of £250,000 or more. Net assets for these purposes do not include –

i. the property which is my primary residence or any loan secured on that residence;

ii. any rights of mine under a qualifying contract of insurance within the meaning of the Financial Services and Markets Act 2000 (Regulated Activities) Order 2001; or

iii. any benefits (in the form of pensions or otherwise) which are payable on the termination of my service or on my death or retirement and to which I am (or my dependants are), or may be, entitled.

I accept that I can lose my property and other assets from making investment decisions based on financial promotions.

I am aware that it is open to me to seek advice from someone who specialises in advising on investments.

Signature:

Name (PRINT IN CAPITALS):

Date:

First Flight NED and Advisors Ltd. Privacy Policy

This Privacy Policy provides information on how First Flight NED and Advisors Ltd uses the information that you give us when you register with us.

First Flight NED and Advisors Ltd is committed to ensuring that any personal information that we hold is protected. If we ask you to provide us with any personal information, you can be guaranteed that this information will be used in accordance with this Privacy Policy.

Generally, we collect the following information:

Personal information is collected when you register in the following ways:

We do not share your information with any other organisations / websites for marketing, market research or commercial purposes.

We may share personal data externally to the business. Where we share your information, we shall do so for the following reasons:

Our use of your personal data will always have a lawful basis, for example:

Unless subject to an exemption under legislation, you have the following rights with respect to your personal data:

You are not required to pay any charge for exercising your rights. If you make a request, we have one month to respond to you.

If you wish to exercise any of your individual rights, you can do so by emailing This email address is being protected from spambots. You need JavaScript enabled to view it. or in writing to: The Data Protection Officer, First Flight NED’s and Advisors Ltd, Hatherley House, Bisley Green, Bisley, Woking GU24 9EY.

First Flight does not use solely automated decision-making, including profiling in the processing of your personal data.

Where we process your data under the consent lawful basis you have the right to withdraw consent. You can withdraw your consent by contacting us using the details at the top of this Privacy Policy.

You have the right to lodge a complaint with the UK’s Supervising Authority: The Information Commissioners Office. Prior to lodging a complaint, we would like the opportunity to address any complaint you may have. Should you have a complaint please in the first instance contact us at This email address is being protected from spambots. You need JavaScript enabled to view it., by telephone on 01797 270271 or write to us at First Flight NED’s and Advisors Ltd, Hatherley House, Bisley Green, Bisley, Woking GU24 9EY

If your complaint has not been resolved or you are not happy with our response, you can lodge a complaint with the Information Commissioner’s Office via email https://ico.org.uk/global/contact-us/email/ or by writing to:

Information Commissioner’s Office

Wycliffe House

Wilmslow

Cheshire.

SK9 5AF.

Or by telephone on 0303 123 1113.

Our website may place or access Cookies on your computer or device and they are only used by us. We use Cookies to improve the user experience on our website. We do not use third party advertising on our website so third party Cookies should not be placed on your computer or device as a result of visiting our website. In addition, our website uses analytics services by Google and others, who also use Cookies; this is a set of tools used to collect any usage statistics that enable us to better understand how users use our website. For further information, please see our Cookie Policy.

If you have any questions about our website or this Privacy Policy, please contact us by email at This email address is being protected from spambots. You need JavaScript enabled to view it., by telephone on 01797 270271 or write to us at First Flight NED’s and Advisors Ltd, Hatherley House, Bisley Green, Bisley, Woking GU24 9EY.

This Privacy Policy may be changed from time to time (for example, if there is a change in the law). We recommend that you check this page regularly. We do not wish to bother you with lots of minor amendments, but where we make significant changes to our policy, we may contact you to inform you.

Ian Hobday - Founder & CEO

First Flight NED and Advisors Ltd.

To provide you with some information on First Flight's Chair and Non-Executive Director service:

You don't have to pay to register as a candidate with us or to apply for any role that we advertise. Please note that we have no connection to any of the companies that ask you to pay to access NED roles and we advise all serious NED candidates to be very sceptical about these companies.

The "Available Roles" page on our website describes the NED roles we are currently finding candidates for, and the skills, qualities and backgrounds our clients are seeking. If you fit the candidate description of any of the roles advertised and are interested, please apply by clicking on the "apply" button on the role spec. You don't need to have met us first.

If you are not a match for any of our current advertised roles but believe that you have the right experience, knowledge and personality to contribute to Boards as a NED, please register your CV with us, so we can notify you of suitable roles. Before registering, please read our advice on: What makes a good Non Exec CV

Once you are registered you will receive emails automatically from us if a new NED role fits your criteria.

If you want to find out more about what it takes to be a Non Exec, we recommend that you read our First Flight Non Exec Guidelines

We run Non-Executive Director workshops which are an excellent way for candidates seeking their first NED role and recently appointed NEDs to find out more about being a Non Exec; further details are on our Non Exec training page.

We have completed some 170 Chair & Non Exec projects across all sectors and we work with companies at all stages including early stage companies such as Pod Foods who we provided with a Chair & 3 Non Execs which has been a big success with 25 outlets to date and £300m Simplyhealth who we provided with 2 Non Execs - see case studies: Pod & Simplyhealth - you can also see case studies on our Case Study page which include two recent projects: HSSMI & Reliance Mutual

Bank Chambers

60 High Street

Cranbrook

Kent TN17 4LN

Tel: 01797 270271

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Company Registered in England No. 5871276

VAT No. 889 4332 72

The "ideal" Non-Executive Director should bring these qualities:

The "ideal" Non-Executive Director should:

Read the survey: "Contributions Non Execs Make to Boards"

A Non-Executive Director CV should be different from an Executive one; it should be 2-3 pages maximum and contain a combination of the following:

Your CV should include:

1) Contact details

Your address, email & phone numbers should be detailed on the first page. A LinkedIn profile address can also be useful.

2) Your profile, summarising core skills, or useful experience you would offer a client company in a Non-Exec or Chair role which should include your personal areas of expertise.

Be succinct (preferably fewer than 6 points and certainly no more than 8). Ensure that your expertise and experience are backed up by career achievements. These are likely to be a mix of skills that companies require from their Non Execs or around their Board Room table (as per a role spec) such as:

3) Current and Previous Board-Level Experience

As an actual Chairman, Director or in pro bono Director-like roles such as a Board Consultant, CoSec, involved Investor, Trustee or Governor etc. it is useful to mention any formal Board Sub-Committees that you have either Chaired or were a member of, and give dates. If legally you were not an actual Director, then don't claim this but mention the role and briefly explain how it was 'Director-like'. If you have not been a NED before this is not a problem but mention if you have attended a Non-Exec course or workshop to prepare you for a Non Exec role.

4) Career record with actual dates including a description of major achievements and responsibilities in your more important roles

Minor/brief/early roles can simply be mentioned without descriptions. Career breaks are not a problem so do not try to hide them. Ideally reading the career record will not only tell us and a client what you have done but also back up the skills and expertise listed in the first section.

5) A Summary of Professional, Educational and Technical Qualifications

Detail relevant qualifications in particular for a particular Board appointment or Board Sub Committee, for example, an accounting qualification for an Audit Committee, or a former FCA/PRA Authorised person.

Click here to register your CV with First Flight

Be wary of Non-Executive Director websites that ask you to pay to register or gain access to Non-Executive roles.

"I was first approached by First Flight for an NED role with ETL Systems Limited and after an initial thorough telephone interview by First Flight, they put me forward to the client resulting in a first on-site meeting. This eventually resulted in an appointment. Due to the very specific high-tech nature of this SME business, I was impressed how First Flight sourced experienced candidates with relevant industry know-how and also arranged for a psychometric test. I can highly recommend First Flight to Companies in need of adding experience to their Boards."

"I was first made aware of First Flight Non Execs through a colleague who recommended them as the best company through which to find NED positions. Like many others, I had retired from full time work but I was keen to find a way of using my skills in helping companies with whom I had an affinity. If appropriate I was also prepared to make a small scale investment at the same time. I found First Flight provided an ideal service for those in my position. There has been a steady stream of high quality opportunities across a diverse range of sectors. When the role of Chairman for the High Speed Sustainable Manufacturing Institute (HSSMI) came along, I applied immediately. From start to finish I have been extremely impressed by the responsiveness and professionalism of Chris and his team. I was provided with all the background information I needed and kept fully informed throughout the interview and appointment process. A first class service which I would enthusiastically recommend to others."

"The experience of dealing with First Flight was rewarding both in terms of finding an outstanding Non Exec opportunity and in the highly professional manner in which the process was managed by them".

"First Flight were excellent in providing me with a very strong insight of the NED role and the client's situation and expectations. As such, I felt very well prepared to be successful. The First Flight team are very knowledgeable and professional about the Non Exec arena and I would highly recommend any candidate seeking a NED role or a company seeking to recruit a NED to use First Flight."